We can’t know everything, even a fraction of everything. If we want to find something out, we need to do research. Typically, we’ll try to look at what else has been researched about a topic. If it’s a very niche topic, then it’s less likely we’ll find something relevant. However, if the topic is popular, one source of inform is the “crowd”. If we’re specifically thinking about economic data, consensus forecasts are a form of crowdsourced data. Indeed, for Turnleaf Analytics, which Alexander Denev and I co-founded recently, we use consensus inflation forecasts as a benchmark to compare our own inflation forecasts, generated using machine learning. We want to compare what we have generated with the crowd’s view. In the political sphere, opinion polls are an example of “crowdsourced” data.

We can also think of the market as another “crowd”. The market is made up of individuals all with different views. They’re placing money behind those views. If we look at the FX options market, we can use it to extract implied probabilities priced in for FX spot moves in the future. This is particularly useful over large scheduled events, which can impact the FX implied volatility surface. Frequency, there will be an event vol add on related to an scheduled event. There surface can also become skewed. Obviously, no one knows the actual outcome of a future scheduled event. However, the fact that is scheduled, does at least allows markets participants to take a view on it. There is also the complication that we often have many scheduled events at the same time. Hence, it can be difficult to disentangle multiple events.

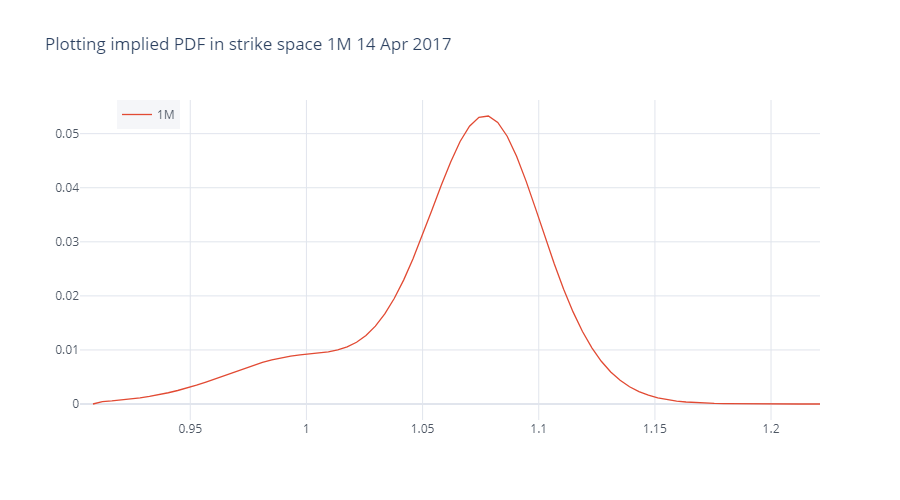

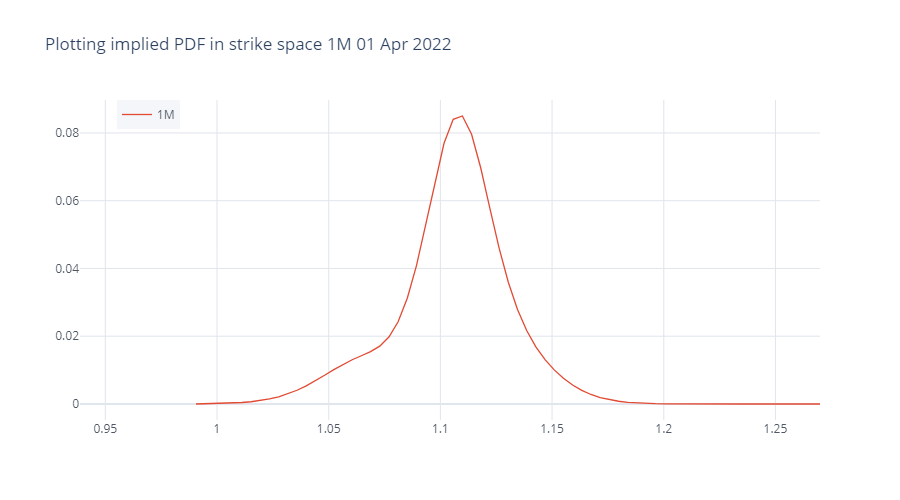

The French presidential election is coming up shortly (10 Apr 2022 for the first round and 24 Apr 2022). We can extract implied PDFs from the FX implied volatility surface for EURUSD, looking at options contract written out to 1M (to cover the first and second rounds), using data snapped from 01 Apr 2022. We can compare the PDFs to those at comparable points before the 2017 Presidential election (where we’ve used 14 Apr 2017 as our reference point). For the below analysis I’ve used various Python libraries including finmarketpy, findatapy and FinancePy. The data has been downloaded from Bloomberg. If you’re interested in the Python code you can get it from a Jupyter notebook from my teaching GitHub page (it also has 2W charts there).

Let’s plot the implied PDFs extracted from the EURUSD implied volatility surface for 1M tenors just before the 2017 and 2022 French presidential elections. Perhaps unsurprisingly, there’s a large tail for EURUSD downside in both occasions, the likely direct of a move in spot if the far right won. In 2017, the left side tail was considerably larger, going down to around -20% from where spot was trading. Polls around 14 Apr 2017 were for 22-23% for Le Pen and Macron around 24%. By contrast in 2022, it goes to around -10% downside. Polls now are at 21% for Le Pen and Zemmour on 11%, and Macron on 26%. Hence, the far right vote is now around 10% more than it was at this stage in 2017.

Going into the second round of the election, it is obviously difficult to know how votes from those eliminated in the first round will be reallocated, amongst the two front runners. Some who voted may also abstain in the second round. However, it seems like a good bet that those voting Zemmour would more likely vote for Le Pen than for Macron. Whilst I’m not an expert on French politics to interpret the poll data (and it could be that I’m missing something), there does seem to be a disagreement between opinion polls and the FX options market at this point.

One argument, can be that in 2017, hence markets were more concerned about a far right win, than was suggested by opinion polls, given the unexpected outcomes of Brexit and the Trump election, given it was very near term memory. In 2022, maybe memories have faded of that shock, and hence, there is less demand for very low delta downside EURUSD options, despite the fact that the far right as whole is polling higher than in 2017. In practice, it is likely that we are probably somewhere in between the two in terms of understanding market concerns over the election, 2017 downside EURUSD was too expensive (again, in hindsight!), and here potentially it is too cheap, when viewed against opinion polls.