Think of Barcelona, and maybe you think of Gaudi, and his (still) unfinished masterpiece the Sagrada Familia or perhaps you think of Picasso, who lived in Barcelona for a period of time. And of course there’s the Olympics, football and Messi. Its history stretches back a long time, and was originally founded by the Romans at the end of the 1st century BC as Barcino.

Earlier this month, Barcelona was the host of the Fixed Income Leaders Summit. It was the first time I had attended the event, which draws together the buy side, sell side and vendors in fixed income space. It’s somewhat larger than TradeTech FX, its sister event which I’ve been to a number of times. Indeed, it was noted how buy side attendance was up significantly this year, likely in light of the volatility we’ve seen in fixed income markets. I also spoke at the event doing a pitch for Turnleaf Analytics, the startup cofounded by Alexander Denev and I where we forecast inflation using machine learning and alternative data, as well as doing a roundtable on the same subject. It was a great experience pitching in front of such a large crowd.

So what were the main themes at the event? In this article, I’ll give my takeaways from the various panels and presentations at the event. For those event which were done under Chatham House rules, I’ll try to give a general flavour of discussions, rather than attribute direct quotations. The topics were split into a number of areas, some targeted more towards traders, tackling the execution, whilst others were more focused towards towards more longer term investors, in particular discussion around views on the macro environment.

Market structure

One of the earliest panels was on Market Structure featuring Yannig Loyer (AXA), Christophe Pannelay (BNP Paribas), Carl James (S&P Global) and Christophe Roupie (Market Axess) with moderator David Bullen (Longwood). Some of the top issues discussed included the evolution of alternative data providers, a theme which has been present in other markets like FX. One important point discussed was how liquidity can be fleeting. When markets are benign liquidity is easy to come by, but in risk off it’s very different. Trading desks have been under cost pressure, doing more with less. Data availability is greater than in the past to help with execution. There was also a public poll to discuss market structure developments. Whilst no choice won a majority of the audience, data automation was cited as the market structure which excited the audience most.

Liquidity

There was a liquidity focused panel, which tried to address how to tap into new liquidity pools. The panel had an audience poll asking what type of signal indicated that liquidity was poor. Perhaps unsurprisingly the top two poll picks were when brokers no longer answered RFQs and when bid/ask spreads widened. When it came to understanding liquidity, Luca Bagato noted that liquidity was different when comparing govvies and corporate bonds. An audience poll at FILS backed this point, with a large number of respondents (71%) citing that they had liquidity concerns about corporate bonds. A distant second was govvies (22%).

Vasiliki Pachatouridi noted how ETFs were being used more in bond markets, and how they had informational power. Sometimes the volumes going through ETFs were more than the underlying. As with other discussions at FILS, the time dependent nature of liquidity was a topic of conversation. Jonas Klink talked about liquidity could drain out, for example at quarter ends and also during risk events (eg. SVB), and how liquidity was becoming more decentralised. In the past, it was more centralised within banks.

Expanding on the topic of liquidity pools was a panel with Odin Costa (Dimensional), Ramon Balje (Flow Traders) and Jasper Jensen (Flow Traders). Ramon Balje presented some slides showing how the ticket sizes in Euro IG were decreasing. At the same time, algo trading was increasing and ETF volumes were increasing. His colleague, Jasper Jensen chimed in noting that whilst ETFs were being used by buy and hold investors, there were also fast money accounts using it as a hedging tool. On the subject of automation, Odin Costa, said that it could be used to create the type of technology which the sell side had access to. Electronic trading had given the market a large breadth of data.

Along similar lines, there was also a panel on execution protocols in fixed income. It was noted how fixed income was seeing more electronification, so called equitisation. It was noted how traditionally the market was more RFQ (request for quote) given that the market has historic been bilateral, and many people had been predicting the death of RFQ for a long time. Counterparties obviously prefer RFQ, but that can result in an information transfer to a broker, compared to RFM (request for market, ie. a two side quotation). Streaming prices was also becoming a reality in fixed income. Even TCA was going away from the use of RFQ, and ultimately a consolidated tape would solve the problem. Often there wasn’t a one size fits all protocol, and depended on your objectives, risk transfer now versus trying to go for a price improvement.

Automation

On the automation panel, perhaps unsurprisingly the topics of data and AI came up. Steve Grob noted that there had been an explosion in the amount of data available. Jon Trickery outlines the complex automation journey when it came to execution. It involved integrating capabilities when it came to liquidity aggregation, and doing pre trade automation. Traders on his desk have access to a data lake to enhance their decision making for execution. The cloud had it easier to move away from desk based data. Ben Jerffreys noted that whilst the cloud made things easier, it was important to monitor costs.

This definitely chimes in with my experiences of the cloud. It is much easier in terms of having a machine maintained by a cloud firm. However, costs come from everywhere, whether it’s storing the data, how much data transfer there is etc.

The topic of build vs buy inevitably came up. Andrea Pirino spoke about how the tech was changing very quickly. Vendors could cater for more common problems, but there’s also a long tail of needs which needed a more tailored solution.

Data, data, data!

The topic of data came up in the majority of panels. The data keynote panel discussed how these days there is lot of data in fixed income, and soon to be even more, with the consolidated tape. It was noted that data could help to automate and rethink your execution workflow, to help you find liquidity. Data could bring more transparency. Obviously the caveat was that there was a cost to the data and the budget had to be managed. There were also questions of who owned the data, is it the trader or the data firm? Ultimately was there a way to simplify ownership of the data.

The macro outlook

There were a number of more macro focused panels, included one on the asset allocation outlook. It kicked off with a question on how tighter monetary policy was impacting markets. Alain Brunschwiler pointed that rates were becoming more volatile, and he thought that they had reached their peak. Investors were going to longer duration. There was more value in EM, where performance was better. It was important to look towards diversification, and to switch between public and private assets, Michela Barlietti noted. On “higher for longer” when it came to rates, she added that default rates were likely to rise, and the pain was still to come. Also on the theme of higher for longer, Frasier Lundie suggested, was not conducive to a soft landing. From an asset allocation perspective, he added that you could look towards the deep and liquid options market to add convexity to your payoff profile.

The discussion of higher for longer also kicked off the macro risks panel with Altaf Kassam (State Street), Iain Stealey (JPM AM), Edward Smith (Rathbones) and Dan Barnes (The Desk – moderator). Edward Smith suggested the whole term of “higher for longer” was problematic. How long is longer? Higher than what? In terms of the outlook, he was in the disinflationary recession camp. He noted that whilst high yield has had a fantastic Sharpe ratio compared to many other asset classes it was a cyclical asset. Iain Stealey had similar views, noting how the tailwinds in the USA could become headwinds. Whilst, the level of yields made fixed income attractive, it was a case of catching a falling knife. Looking towards EM, he noted how their central banks had managed the situation better than those in EM, and that yields in Brazil and Mexico could come down. However, it was a still a country by country argument.

This sentiment of being positive on the bond outlook was shared by Altaf Kassam, and he suggested that fixed income was likely to be a better place than equities in the coming years. However, the market had also changed. Liquidity was being removed, and it was no longer possible to rely on central banks to backstop the market. There were risks, such as the prospect of a US shutdown. On central bank policy, Fed rates would likely peak before the ECB, and hence there might opportunities to fade USD strength, although thus far he had misjudged the USD (have to admit, I had shared a similar view on the USD, which hasn’t yet materialised).

The Price of Time

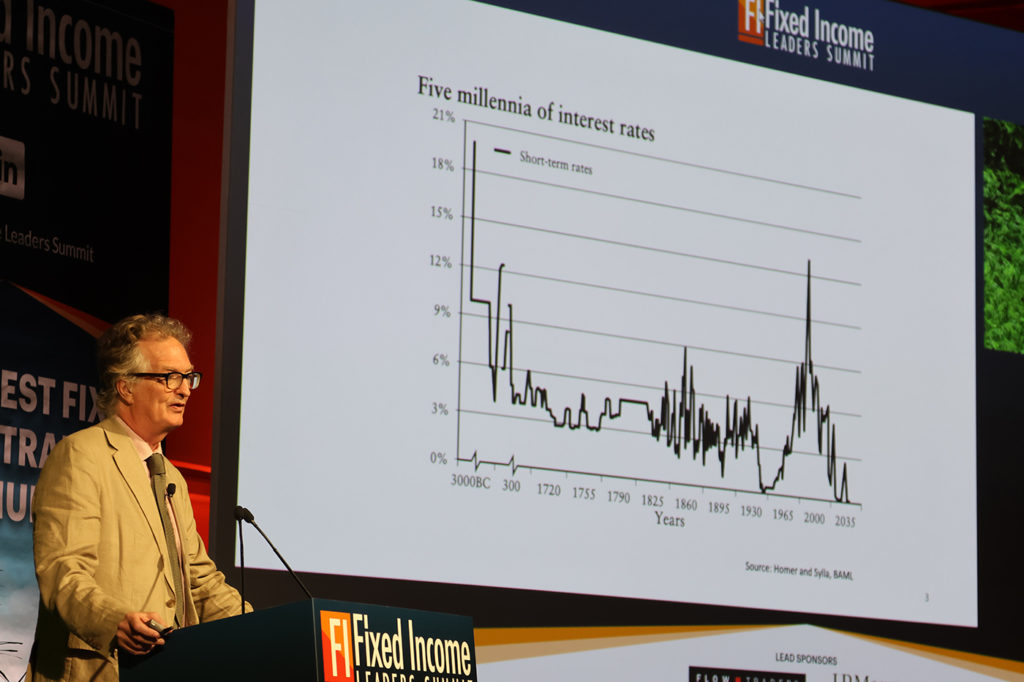

Edward Chancellor’s presentation took a much more longer term look at markets, discussing his book The Price of Time, and the origins of interest, which has a history going back 5 millennia. Originally in Mesopotamia it was used when lending livestock and grains for interest. Ultimately it was an important investment innovation, because interest allowed for a transaction over time, literally it was related to the price of time. There were many functions of interest, such as valuation, capital control and controlling inflation (albeit a somewhat blunt tool for doing so).

Jumping back to the recent past, he noted how interest rates were at unnatural levels. The end of the ultra low rates era had seen a switch in the equity/bond correlation, a number of mini crises and he suggested there could be more to come? Whilst it was impossible to predict where yields would be in the coming years, he did show that historically bond yields tend to exhibit multi decade cycles, and we could well be in the early stages of a multi decade bond bear market. I suppose only time (or perhaps interest!) will tell!

There were many other topics of discussion during the Fixed Income Leaders Summit, including ESG and also the role of diversity and inclusion in the industry. It was noted how diversity comes in many guises and isn’t always necessary visible. Ultimately, it was important that it was important to start early, and that it was a responsibility of all of us in the industry.

My background is largely in FX, although in recent years I have veered towards the economic forecasting side, with my role at Turnleaf Analytics. Whilst fixed income is still a very different asset class, particularly when you look at govvies the drivers tend to be highly related, given it is also a macro instrument. I very much enjoyed the Fixed Income Leaders Summit, given the wide array of discussions ranging from and hope to be back in the future. It was also a great way to catch up with friends and colleagues from the industry.