There’s an election soon in early November, which might have been mentioned at least a couple of times, which everyone is talking about. The elections in Nicaragua. Ok, perhaps not quite that one, but at least it’s roughly on the right side of the world. The US presidential election is always a key event in the calendar of financial markets. As I mentioned a couple of weeks ago, the challenge for traders is to try to divorce their own political preferences from how they trade such events. After all, the goal is to predict who will win, not who you want to win.

One of the most obvious ways to try to try to forecast is to first understand market expectations. One way to do this is to look at market moves in reaction to polls and the recent debate. At least from an FX perspective the consensus is that Biden would be bearish for the dollar, whilst Trump would be bullish. Whoever wins, markets will probably conjure up a reason to buy equities!

It’s also possible to look at vol markets for options contracts that cover the November election date. The higher the vol in these contracts then the more risks the market sees in the election and ING wrote a nice note about this looking at USD/JPY vols. It’s also worth trying to back out the implied distribution of prices from vol markets, to understand the distribution of outcomes, and this is something Iain Clark and I did for USD/MXN before the 2016 election.

Opinion polls are also another dataset which market participants use. Of course, there are many complications, given the electoral college system, national polls aren’t necessarily always going to predict a winner. In practice, you’d need to look at polls in every state and use that in a forecasting model. In both 2000 and 2016, the winner lost the popular vote and won the electoral college and the presidency. In 2000, the last national polls before the election showed George W Bush ahead, so would have “correctly” predicted that Bush would have won. In 2016, the polls correctly predicted that Hillary Clinton would have the largest share of the popular vote, but didn’t predict the winner (and neither did most pundits models).

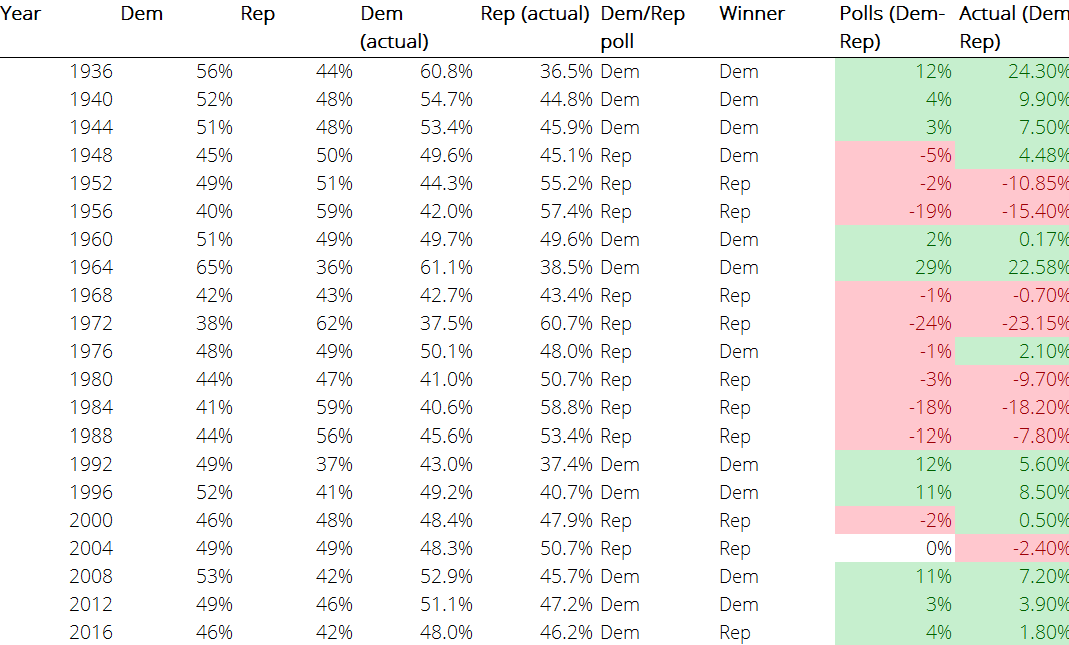

So is it a waste of time looking at polls given 2016? If we look back since the 1930s at Gallup polls just before the election, we find that in the vast majority of cases, the national poll was actually a good predictor of winner. The exceptions were 1948, 1976 and 2016 (in 2004, the last polls were a dead heat, but up until that case, Bush had been ahead). So out of 21 occasions, 3 went the other way. Ok, I know a lot has changed since the 1930s (not sure how prevalent social media was then…!), and there are many unknowns, but still, if you were looking at the data, always fading the polls would have been a losing proposition in the vast majority of cases. It’s also worth noting that after 2016, there have been many occasions where polls have been good predictors of the winner, such as in UK’s general election in 2019 and the last French presidential election, although people seem to forget the successes of polling pretty quickly!

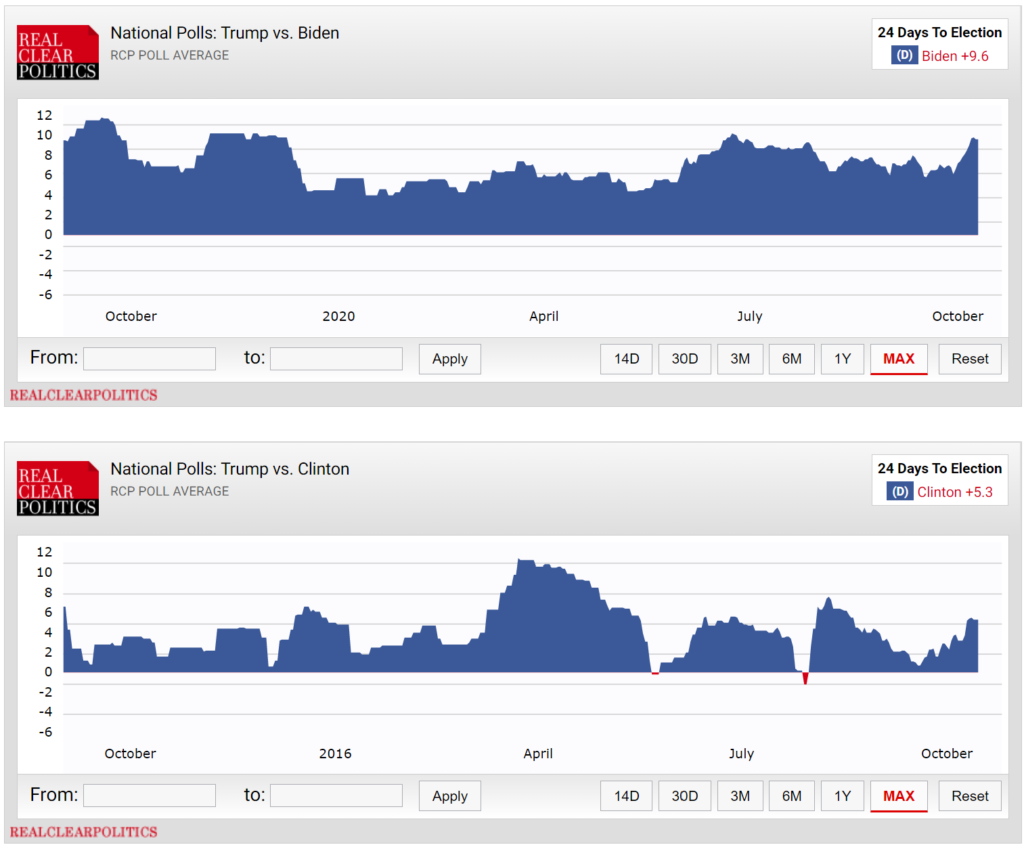

If we compare Biden to Clinton, there are some differences in their polling leads (see this tweetstorm from @geoffreyvs). Clinton was ahead at this point in October, as is Biden, as these polls from Real Clear Politics shows. However, Clinton’s lead was somewhat smaller at this point compared to Biden now (5.3% vs. 9.6%). Furthermore, there was significantly more volatility around her polling figures in the months before, and there were periods when Trump was ahead in the polls 2016 as well, which hasn’t happened yet this time.

Opinion polls and market data aren’t the only datasets we could look at too. We could also look at alternative datasets, such as social media to try to capture voter mood, provided we can cut through all the bots active there.

Of course, it’s several weeks till the election, and let’s face it, a lot could happen between now and then. However, we shouldn’t simply discount polls because of 2016. It’s also worth trying to back out market expectations too.