It’s easy to miss things. However, we simply don’t have enough time to do everything. I like burgers, and I usually use this blog as an excuse to talk about them. Bear with me for a moment, there is a point to this! Let’s say I wanted to find out the best burger in my local burger joint. It’s impossible to try every single burger in one go. No one can eat that much in one sitting! I could try them over an extended period over a few months. If I extend the problem to identifying the best burger in London, and suddenly the task becomes totally intractable. The only way to do it logically, would be to draw up some sort of shortlist to make the problem more tractable.

We have the same problem in many cases in financial markets. There’s just too much information, and it’s not possible to process it all in one go. The Federal Reserve a major factor for financial markets, particularly at the current time. There are numerous speeches made by FOMC members over the months. They publish FOMC statements and minutes. There’s also the press conference after every second meeting. In short, they communicate with the market a lot. Can you read all of this? Yes, you could do, and indeed many people do at least read the statements, listen to the press conferences etc. But in practice, it’s unlikely every market participant will read the majority of Fed communications, given simply how long it’ll take. Is it possible to read it an unbiased way too, without taking up lots of your time?

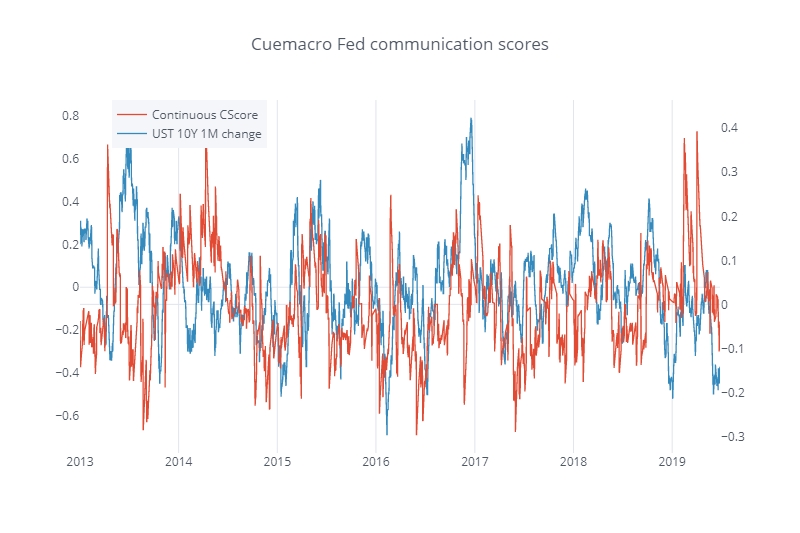

One solution is to get a computer to read Fed communications. Indeed, this is what Cuemacro’s Fed sentiment index does above. It aggregates a large body of Fed communications and does natural language processing on it, coming up with sentiment scores for each. It then aggregates that into an index, which can be used to gauge the overall sentiment of the Fed. Higher scores indicate more positive sentiment, and a more hawkish outlook, whilst negative scores indicate a more negative sentiment and hence more dovishness from the Fed. In the above, plot we see that the index correlates fairly well with 1M changes in UST 10Y yields, which suggests there is a relationship between how the rates market behaves and our measurement of Fed sentiment.

If you work at a financial firm and would be interested in getting a trial of Cueamacro’s Fed sentiment index, drop us a message and we can give you more information about what it is, and you can use it within your investment process. Furthermore, clients get access to the raw data, to do their own customised analysis.

Alternatively, we just ignore looking at most of Fed communications. However, this means missing a lot of what could impact price action. Using an automated index, like Cuemacro’s Fed index can help fill in these blind spots in market information. Other market participants will almost be certainly be looking at everything the Fed says, and using that in their investment process. Clearly, not doing so, will put us at a disadvantage, something no trader wants.