The Berkshire Hathaway shareholders meeting returned in person for the second time after COVID this weekend in Omaha. As noted by Warren Buffett, there was somewhat of a clash in the calendar with the Coronation over the Atlantic, although he did quip that they had their own King Charles here at the meeting, in the form of his business partner Charlie Munger.

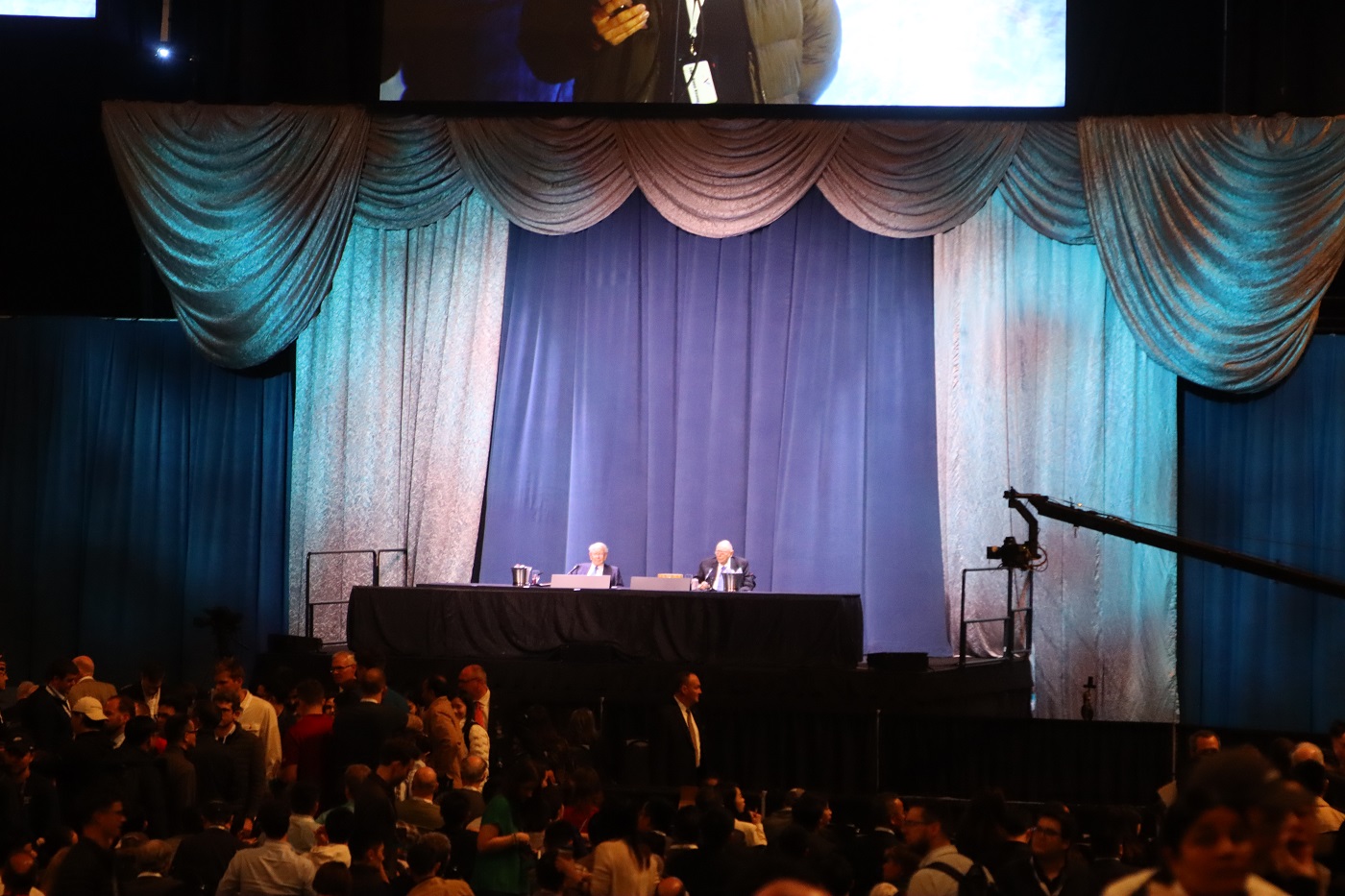

As usual the format of the event started with a run down of Berkshire Hathaway’s financial results, followed by a large number of questions to Warren Buffett and Charlie Munger. Their colleagues Greg Abel (Buffett’s successor) and Ajit Jain also took part in the first half of the question and answer session.

Buffett kicked off by noting that the general environment was very different compared to 6 months ago, with an extraordinary period of fiscal stimulus and a massive demand from consumers for goods. He was expecting that the majority of Berkshire Hathaway’s businesses would report lower earnings as a result. He also noted how insurance underwriting does not correlate with business activity, it was more correlated to large events, like hurricanes and earthquakes. It also provides a float (of 165bn USD), in a sense it was like being bank, but without depositors.

One of the first questions was unsurprisingly about the recent SVB failure, and what would have happened without a guarantee. Buffett noted it would have been catastrophic if the deposits hadn’t been guaranteed. He couldn’t imagine anybody wanting to be the one who announced on TV that they were only guaranteeing 250k (as per the FDIC) and implicitly starting a run. Later on there was a related question about the difference between small banks and big banks and the perceived implicit guarantee. More broadly he noted that there was public confusion about the banking system. The message from politicians, agencies and the press had been poor. There was no interest in a bank failing. Had a demonstration of SVB being saved, but still the public was confused. He also said it was necessary for those in management to be punished for failings in banks. Their CEOs needed to be accountable.

One of fintwit’s favourite topics also come up, about the USD’s status as a reserve currency, and the size of the national debt. Buffett noted that there was no other option for a reserve currency. There were issues with fiscal policy, and Powell understands it, but ultimately he’s not in control of the fiscal side, even if he drops hints. On the question of how far it can go (in terms of monetisation), he noted how we learnt in WW2 that the inflation rate went from 1% to 15% as a result of monetisation. America is rich society, Buffett pointed out, but it can’t print money indefinitely. Munger added that at some point printing money to buy votes will be counterproductive. It wast true that Japan did it, but they did not have a reserve currency, and also the culture was different there. The main protection against inflation, Buffett noted, was your own earning power. You will succeed with your talents, but not by hoarding dollars.

There was also question about Elon Musk to both Buffett and Munger, asking whether Musk overestimated himself. Munger quipped that Elon likes to take on the impossible. By contrast Buffett and Munger, were looking for the easy jobs! By and large, Buffett enjoyed what he was doing, and felt Elon wouldn’t like to be in his shoes in any case.

There were many questions asking for advice from Buffett and Munger, both in terms of business and personal life. For one Buffett noted, he was lucky to be in the USA, and as a broad principle he suggested writing your obituary and working out how to live up to it. He had got wiser with time. Mistakes in business happen, but they shouldn’t take you out of the game. More broadly, spend a little less than you earn, he advised. Munger agreed with the notion of spending less than you earn, and it was important to avoid toxic characters.

There were many questions around Berkshire Hathaway’s energy businesses, in particular the energy transition. Buffett noted that for example in Iowa they now produce more wind energy. Some counties there welcomed wind, but others did not. Their record in wind and solar has not been topped by other utilities. Munger added that even if you were not worried about global warming (he suggested there were too many unknowns about the future), it was still better to shift to renewable to save using hydrocarbons.

Given recent developments in AI, it was perhaps unsurprising that Buffett was asked about its potential impact. Buffett noted it can do amazing things, but it can’t be uninvented. Somewhat rephrasing an Einstein quotation, Buffett noted that, with AI, it can change everything in the world, except how men think and behave.

I’ve been to Omaha many times to the Berkshire Hathaway shareholder’s meeting. It’s always been an interesting day, and I have to admit it’s quite unique as an event, that brings together many folks interested in markets.