Walking around Omaha, there are reminders of the old West. In the Old Market district, the cobble stones remain, but the old style saloon bars are gone. In their place there are fancy restaurants and bars. There are sculptures of old Omaha, stagecoaches cast from bronze. The railroad is still there, but the original station has been converted into an art gallery.

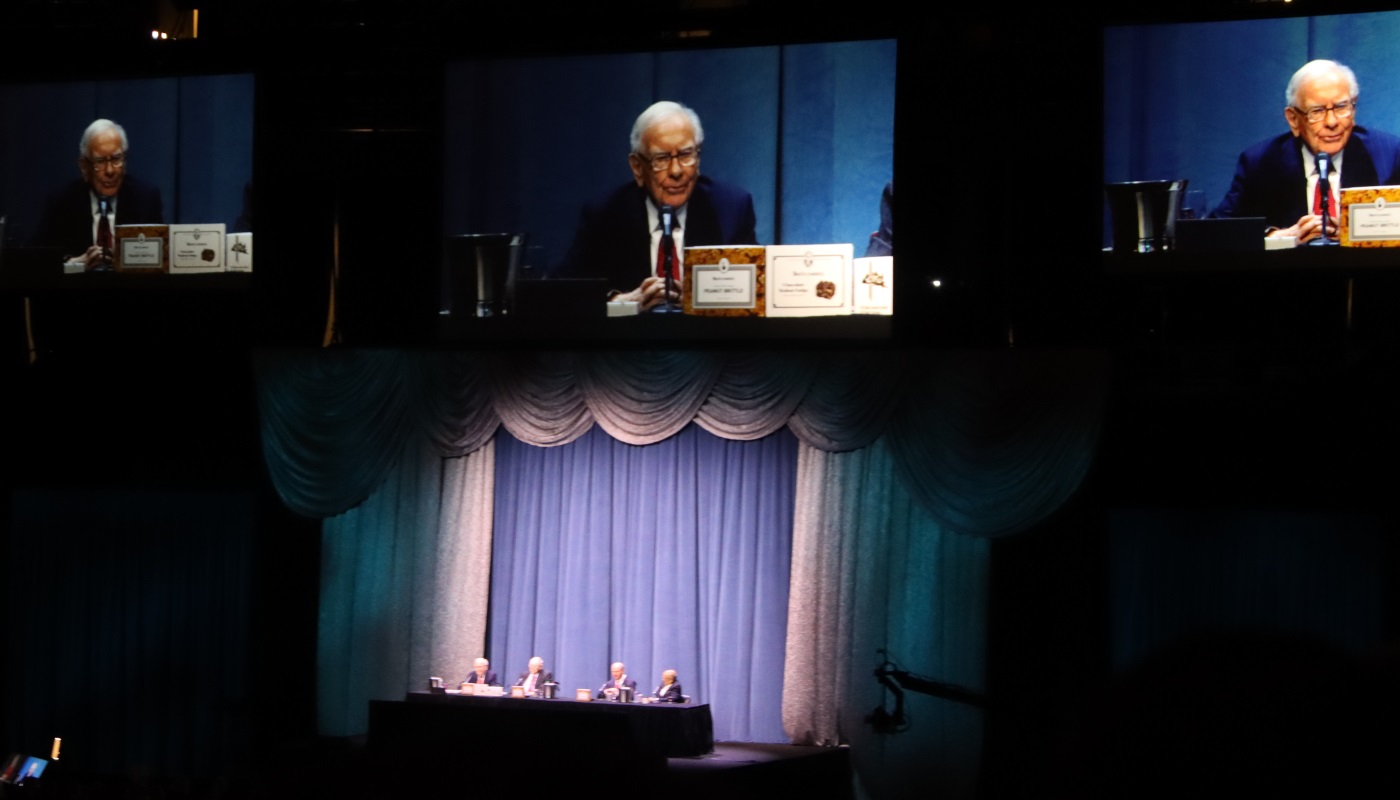

Every year in late April or early May, thousands converge on Omaha from across the USA and from further field. Whilst some of them might be coming partially to enjoy the old West and Nebraska steaks (and I include myself in that category), the vast majority are coming purely for the annual Berkshire Hathaway shareholders meeting. The 2022 meeting was held on Saturday, the first in person meeting since 2019. It’s a somewhat unique event in investing. Yes, there are countless financial events every year, but this is the only one which seems to have the feeling of a festival. For hours, Warren Buffett and his business partner Charlie Munger answer questions from shareholders about the firm and also more general questions regarding investing. This year Greg Abel and Ajit Jain from the management team also joined them on stage for part of the time. So what were the key takeaways from this years meeting?

By and large, Buffett was sceptical of the notion of being time markets, a topic he’s touched on many times before. He noted that he failed to spot the opportunity in March 2020. That being said, a questioner did note that he has been fortuitous on many occasions where he did time his investments well. On the topic of inflation, Buffett was equally sceptical that it was possible to predict for example what inflation would be in the coming month or so.

I would nevertheless argue that ultimately predicting these macro variables is a relative exercise. Trying to predict inflation is difficult particularly as you extend your horizon, and it’s something that Turnleaf Analytics, which Alexander Denev and I co-founded, is doing by leveraging techniques like machine learning and alternative data. Ultimately, you can profit from forecasts, not necessarily by getting the number perfectly correct several months out (which is going to be exceptionally hard!). Rather it is about trying to do better than the market and its consensus. Given it is so hard to forecast, consensus has difficulty getting it right. Of course it isn’t easy to beat consensus (but clearly somewhat more doable than attempting to get the number exactly right), but if you can, that can be monetisable in itself. Alexander and I have also found that new techniques can also be very helpful like machine learning and the use of alternative data, when it comes to inflation forecasting.

Further on the topic of inflation a questioner asked how investors could hedge themselves. Investors are swindled by inflation, and ultimately the best hedge, Buffett noted, was your own skills. Whereas inflation may eat into returns, it doesn’t take away your skills. The best investment he noted was invested in yourself. Skills cannot be inflated away.

There was a pushback against the notion that Berkshire Hathaway should be split up to realise more value. There was also a defence of the idea of repurchasing stock, of which Berkshire Hathaway were has been very active in this year. Buffett said that with all the words written about share repurchases it was a simple idea. If you repurchase your stock, it is because at the time there is nothing better than buying your own business.

Buffett noted that it was difficult to find targets for acquisition given they needed to be sizable. He noted that it was complicated to purchase businesses outside the United States, but if they got a call tomorrow to do a substantial deal outside the USA they’d do it. Indeed opportunities could be anywhere, and he cited examples of deals he’d done in Japan and Israel.

Another topic that came up, was that of shareholder access. Both Buffett and Munger railed against the idea of giving large shareholders any different access to information, through special meetings etc. All information would be communicated to all shareholders. They really did not like the idea of how many firms communicate to the market, such as through the use of earnings forecasting and the use of investor relations.

There was significant scepticism in the “gamification” of markets in recent years, both from Buffett and Munger. Buffett bemoaned how markets had become a “gambling parlour” and companies had become poker chips, as opposed to a vehicle for investment. Wall Street makes money from trading, consuming the crumbs that fall off the table of capitalism, Buffett noted. At the same, the large amounts of liquidity generated in the market, provided Berkshire Hathaway with an opportunity to take stakes in firms in a relatively short space of time. Munger in particular deplored the way that retail had been encouraged as “disgusting”.

The question of politics and how much a company should get involved, was also asked. The difficulty with taking active political positions, is that it risked alienating people and that they would take it out on your firm. Buffett also noted he was not a fan of the polarisation of politics, and it resembled the 1930s, when there were similar splits around FDR.

Crypto came up as a topic as usual, but unsurprisingly, the views of Buffett and Munger haven’t really changed. Buffett noted that even if you offered me all the bitcoin in the world for 25 USD, he wouldn’t buy it. His point was that it wasn’t worth purchasing because it was not a productive asset. Instead of was held, given you were waiting for a guy to pay you more.

Munger summed up his view of bitcoin in three points, it was stupid because it’ll go to zero, it was evil because it undermines Fed and make us look foolish vs China. I’m not sure whether I would hold precisely the same view, but ultimately it is difficult to argue that bitcoin is a productive asset, in the same way as stocks are, and instead the closest analogue would be gold. Gold again is mostly held for investment, but does have the advantage of a track record of many thousands of years which bitcoin does not (yet!!) have.

All in all, it was very enjoyable to be at the Berkshire Hathaway meeting, and it’s a great way to meet other folks interested in financial markets. I’ve been to several Berkshire Hathaway meetings over the years (this was my fifth), and I’m really hoping that we can all converge on Omaha for the 2023 meeting. And yes, I did get some Sees Candies whilst I was there.