It can often be easy (and wrong) as a market practitioner in FX to think of moves from purely a speculator’s point of view. However, as probably seems blatantly obvious, the behaviour of speculators in the FX market is not conducted in some vacuum. It is an amalgamation of many other transactions which are not primarily done for the purposes of speculation on the FX rate. Whenever we go abroad, we have to buy foreign currency, not because we want too.. but because we might want to buy a burger at our destination! As a practitioner, it can often be good to sometimes take a step away from the market, and see other perspectives on FX markets, in particular from academia. I recently attended the 2017 Annual Conference in International Finance, organised by Pasquale Della Corte, Maik Schmeling, Giorgio Valente and Christian Wagner. It has been running for the past few years and is always a highlight of the calendar for the discussion of new academic research in the field of international finance. In this article I shall pick out some of the papers discussed at the conference.

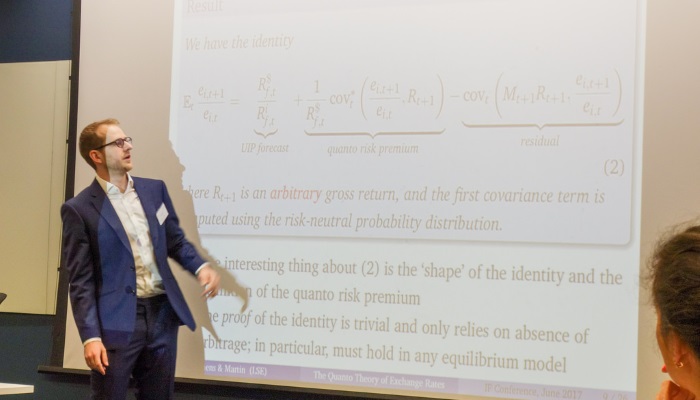

The best paper award was given to The Quanto Theory of Exchange Rates by Lukas Kremens (pictured above) and Ian Martin. The basic idea of their research was to examine quanto contracts to augment currency forecasts. Quanto contracts are denominated in a foreign currency. In their case they looked at quanto contracts S&P500 denominated in EUR and compared their pricing to ordinary USD denominated forwards on S&P500 of the same tenor. They found that their approach outperformed other forecasting methods, such as PPP, uncovered interest rate parity and also a random walk. Obviously, there are certain caveats, notably the dataset is relatively short which they used (2009-2014), which was limited by the availability of quanto contract data. However, despite this, I found the approach certainly very novel and something I had not seen previously. It is something which I might seek to model in the future.

Lucio Sarno presented his research (with Steven Riddiough) on Business cycles and the cross section of currency markets. Whilst FX carry has been the subject of much research both by academics and practitioners alike, it is somewhat less common to see work discussing the relationship between business cycles and FX. Generally, the datasets seem more tricky to work with and also you have other difficulties, such as when implementing these models you also have to be careful in creating point in time estimates for generating trading signals. The main hypothesis of the paper is that stronger economies should generate higher currency returns, which they found to be the case in the study. Using industrial production data and OECD leading indicator data as proxies for economic growth, they created FX baskets, buying the currencies with the highest growth and selling those with the weakest. They found that these baskets were broadly profitable. Much of the returns came from spot appreciation, rather than carry. Furthermore, the basket did not seem correlated to carry. One thing I have found time and again in FX, is that it is very easy to spend a long time creating a strategy only to find it is carry in disguise! Hence, it always pays to use carry (and also trend) as a benchmark to be compared against, when developing an FX based strategy. One point, I would have is that it might be interesting to compare the returns for such a business cycle strategy to that which generates FX signals form the changes in interest rate differentials. After all, in developed markets we can think of these types of FX based interest rate strategies as ways of creating a proxy economic growth.

There was also a presentation by Tarek Hassan of his paper Currency Manipulation (with Thomas M. Mertens and Tony Zhang). Whilst, we tend to think more of about the behaviour of central banks seeking to target specific levels, there is also the case of “currency stablisation” that is trying to dampen volatility of a local currency versus a much larger country’s currency. The research sought to model what the impact of this was. One of the results from the paper was that a small economy stabilizing its currency relative to a large economy increases domestic capital accumulation and wages. The conference was rounded off by a discussion by Matteo Maggini on Unpacking Capital Flows, where he discussed a few interesting results about the behaviour the investors with respect to home currency bias. His work is still at a very preliminary stage and I am very much looking forward to reading the final paper on the topic. For a full list of the papers discussed please click here.